Our Strategy: Focused investing. Hands-on execution. Value, delivered.

Acquisitions

Sourcing intelligently. Executing with discipline.

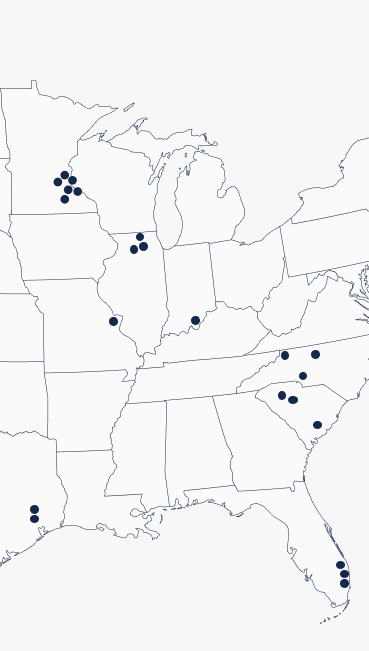

Since 2012, Monument has acquired over 15,000 multifamily units across 16 states, with a focus on the Southeast and Midwest. We invest in markets characterized by strong household formation, sustained employment growth, and limited new supply—creating clear opportunities for value and growth.

We pursue assets where we can unlock value through operational upside, tailored renovation programs, and an active, hands‑on approach to ownership. Our disciplined due diligence process tests every assumption, substantiates costs, and unites all teams to ensure an immediate and coordinated rollout of the business plan at acquisition. We design capital structures that balance efficiency and flexibility, tailored to each investment’s strategy while mitigating downside risk.

Our vertically integrated management arm, Monument Real Estate Services, delivers disciplined execution, advanced technology, and a resident‑centric approach. We apply institutional best practices with the accountability and care of an owner‑operator to each property.

Our centralized operations platform supports properties across multiple states, leveraging innovation to achieve scale without compromising efficiency or service. We pilot new solutions at select communities, analyze results, and expand proven initiatives—ensuring we anticipate industry shifts rather than react to them.

By integrating property management and asset management, we enable disciplined execution and clear accountability. Our teams track performance in real time and pivot quickly to remain focused on pursuing the financial and operational objectives established for each investment.

Property Management

Construction Management

Each investment starts with a well-defined, asset-specific capital plan - crafted early, refined through diligence, and designed to unlock value. We’ve developed proprietary tools that deliver transparency, control, and seamless execution to one of the most critical components of value‑add real estate: capital project management.

From due diligence to final invoice, our internal system connects capital planning directly to property financials, effectively integrating our accounting and property management platforms to maintain oversight throughout the investment.

Construction oversight isn’t a separate function – it’s embedded in our operations. Our asset management and property management teams work in tandem, using shared systems and aligned incentives to execute renovations efficiently and deliver measurable impact at the property level.

We continuously reassess scope, timing, and spend in real time to ensure the return on capital is accretive to the investment.

Monument Capital Management has acquired over $1 billion of multifamily real estate assets across 16 states through a series of opportunistic private equity funds and joint ventures.

- Active Investments (22)

- Realized Investments (86)